Proposed stress protocol for collateral stirs debate

June 30, 2025 (NO COMMENTS)Isda Future Leaders recommendation seen as useful thought exercise, but difficult to implement

Esma still open to minimum thresholds for onshore clearing

June 27, 2025 (NO COMMENTS)Final active account rules ease reporting burden, but no guarantees on outcome of 2026 review

US G-Sibs’ non-bank assets surpass $6trn for first time

June 26, 2025 (NO COMMENTS)After plateauing for years, non-bank asset shares surged in 2024, led by Citi and JPM

Hedge funds scale back steepener positions as risks rise

June 26, 2025 (NO COMMENTS)Uncertainties around US Treasury issuance and timing of rate cuts see investors trim ‘consensus’ trade

Chinese corporates shunned hedging during tariff upheaval

June 26, 2025 (NO COMMENTS)High hedging costs and increasingly stable spot rate meant exporters opted not to add FX hedges as RMB rose

Numerix strikes Hundsun deal as China pushes domestic tech

June 26, 2025 (NO COMMENTS)Homegrown tech initiative – ‘Xinchuang’ – a new challenge for foreign vendors

Brain drain at OCC raises concerns about US model supervision

June 25, 2025 (NO COMMENTS)Quant team cull will reduce capacity to validate bank models, but that could be part of the plan

How Brightwell navigates a world of change

June 23, 2025 (NO COMMENTS)‘One portfolio’ approach helped UK pension fund steer a course through trade turmoil, Covid and LDI crisis

US banks’ FX notionals hit record $66trn on forwards frenzy

June 23, 2025 (NO COMMENTS)JP Morgan leads record derivatives surge amid Q1 market volatility

Tariff turmoil tests limits of market risk playbooks

June 20, 2025 (NO COMMENTS)Risk Live: Volatile markets reveal need for quicker data and more dynamic risk limits

LCH plans Q4 launch for FCM-style clearing

June 20, 2025 (NO COMMENTS)UK clearing house will be first to offer Europe’s new agent model as Eurex faces tax hold-up

BNP Paribas eyes selective algo white label tie-ups

June 19, 2025 (NO COMMENTS)The French bank struck its first FX algo white-labelling partnership with Lloyds

OCC payment obligations hit record in Q1

June 19, 2025 (NO COMMENTS)Liquid resources up 6.5% as liquidity risk grows to new highs

Barclays takes selective approach to FRTB IMA applications

June 18, 2025 (NO COMMENTS)Risk Live: UK bank is applying for approval for parts of its portfolio most likely to pass approval tests

BoE official plays down fears of global regulatory fragmentation

June 18, 2025 (NO COMMENTS)Risk Live: UK expects close co-operation with the US, while others express concern over the Basel III endgame

US Basel III delay to 2026 seen as almost inevitable

June 18, 2025 (NO COMMENTS)Reprioritisation and leadership changes cast doubts on timing of new proposals

Allocators try to stay strategic in a world turned upside down

June 17, 2025 (NO COMMENTS)Investors are revisiting long-held assumptions about how to allocate large pools of assets

Unseasonal Q1 surge lifts G-Sib scores to record highs

June 17, 2025 (NO COMMENTS)Latest systemic risk scores for JP Morgan, Citi, Goldman and Morgan Stanley could lead to extra 50bp to their respective capital surcharges

Will Taiwan lifers ramp up FX hedging amid tariff turmoil?

June 17, 2025 (NO COMMENTS)As TWD remains strong against the US dollar, Taiwanese life insurers are still poised to act

Passing the port? Drill needs more CCP hands in key test

June 16, 2025 (NO COMMENTS)As few plan to test porting, brokers say finer asset segregation, reg waivers and capital relief would help

Trading venues seen as easiest targets for Esma supervision

June 16, 2025 (NO COMMENTS)Platforms do not pose systemic risks for member states and are already subject to consistent rules

Why asset owners aren’t turning their backs on America (yet)

June 9, 2025 (NO COMMENTS)Pension and sovereign wealth investors see US exceptionalism outlasting policy-driven turmoil

Repo facility preferred over discount window, SFOs say

June 9, 2025 (NO COMMENTS)Bank officers shun Fed lending facility amid persistent stigma

Citi close to launching GenAI investment tools

June 6, 2025 (NO COMMENTS)New tech will be used to improve investment recommendations and increase cross-selling

First Citizens used AI to retain SVB customers

June 6, 2025 (NO COMMENTS)Retention effort involved using AI to monitor customer behaviour and sentiment – including profanities

SEC faces debate over possible cull of cyber security rules

June 6, 2025 (NO COMMENTS)Lobby groups pushing for regulator to roll back disclosures, but investors take a different view

Limited-loss hedges help US firms dodge costly FX moves

June 5, 2025 (NO COMMENTS)Structurers say corporates’ use of options-based net investment hedging helped soften impact of USD selloff

Deutsche Bank takes AutobahnFX on the open road

June 3, 2025 (NO COMMENTS)Proprietary trading platform sets out new workflow-based approach to collaborating with venues

CCAR at a turning point, but which way is forward?

June 2, 2025 (NO COMMENTS)Banks sniff an opportunity to push the Fed for more openness over stress test models – and seize capital benefits

Supervised similarity for high-yield bonds

June 2, 2025 (NO COMMENTS)Quantum cognition ML is used to identify tradable alternatives for high-yield corporate bonds

CVA capital charges more than double at BPCE post Basel-III

June 2, 2025 (NO COMMENTS)French bank leads European trend of elevated capital requirements under new rules

Risk managers brace for night shifts as 24-hour trading looms

May 30, 2025 (NO COMMENTS)Questions swirl around how margin breaches and defaults will be handled during overnight hours

Fed agrees to unveil stress test models in transparency U-turn

May 28, 2025 (NO COMMENTS)US regulator commits to September 30 deadline for new measures

Leverage ratio reform: the good, the bad and the Treasury

May 27, 2025 (NO COMMENTS)A simple cut would be less likely to stoke interest rate risk than exempting US government bonds

Disclosed trading an oasis in the FX liquidity ‘mirage’

May 20, 2025 (NO COMMENTS)LPs say growth of relationship-based trading bolstered market during April volatility

Emir 3.0 could complicate Eurex launch of repo on Prisma

May 13, 2025 (NO COMMENTS)Clearing house now targets November 2025, but faces hurdle from new model change approval process

CRE non-accruals still rising at Western Alliance and Valley National

May 13, 2025 (NO COMMENTS)Troubled CRE loans rise further in Q1 despite rate cuts and loan modifications

Vendor oversight splinters across FMIs

May 13, 2025 (NO COMMENTS)Op Risk Benchmarking: firms grapple with “chaos” of third-party rule changes, amid growing recognition of cyber and resilience threats

Hedge funds burned as Hong Kong dollar bets implode

May 12, 2025 (NO COMMENTS)Carry trades and call spreads unwound after Trump tariffs pushed spot to edge of currency peg

European investors ramp up FX hedging as ‘dollar smile’ fades

May 6, 2025 (NO COMMENTS)Analysts at one bank expect average hedge ratios to jump from 39% to 70% within six months

CLO market shakes off ETF outflows

May 5, 2025 (NO COMMENTS)Despite record redemptions, exchange mechanics and relatively small volumes cushioned impact

ECB removes need for governing council to approve CCP facility

May 2, 2025 (NO COMMENTS)New “automatic” facility will require safeguards that are “still being implemented”, bank says

Systemic risk jumps at Chinese G-Sibs in 2024

May 2, 2025 (NO COMMENTS)OTC derivatives and securities volumes drive sharpest increases in 10 years

Pension funds hesitate over BoE’s buy-side repo facility

May 2, 2025 (NO COMMENTS)Reduced leveraged and documentation ‘faff’ curb appetite for central bank’s gilt liquidity lifeline

US Basel equivalence questioned as EU patience wears thin

May 1, 2025 (NO COMMENTS)MEPs say unfaithful US implementation of Basel III could trigger review of access to EU markets

‘This is not a wobble’: Brunello Rosa on the path to de-dollarisation

April 28, 2025 (NO COMMENTS)Digital currencies will play a central role as China challenges US hegemony, says economist

Synthetic deals drive securitisation RWA surge at EU banks

April 28, 2025 (NO COMMENTS)

One year on, EU banks get greener as GARs grow

April 25, 2025 (NO COMMENTS)Contentious green asset disclosures show improvements for most major European banks in 2024

Repo clearing rule could raise SOFR volatility – OFR analysts

April 25, 2025 (NO COMMENTS)Analysis of 2022 data finds large divergence in tail rates but no change in median

Investors dip a toe back into Tips despite April losses

April 25, 2025 (NO COMMENTS)US inflation-linked bonds back in vogue as stagflation hedge

Supervisors should be mindful of geopolitical risks, says IMF

April 16, 2025 (NO COMMENTS)Shock events cause sizeable swings in asset pricing, institution’s latest report highlights

Why AI will never predict financial markets

April 16, 2025 (NO COMMENTS)The laws that govern swings in asset prices are beyond the statistical grasp of machine learning technology, argues academic Daniel Bloch

JP Morgan’s equity and commodity VAR soar to five-year highs

April 16, 2025 (NO COMMENTS)Trading risk gauges jump 150% and 190% amid Q1 trading flurry

European Commission changes tune on proposed FRTB multiplier

April 16, 2025 (NO COMMENTS)Banks fear departure from original diversification factor undermines case for permanent relief

Inside the week that shook the US Treasury market

April 14, 2025 (NO COMMENTS)Rates traders on the “scary” moves that almost broke the world’s safest and most liquid investment

Ice eyes year-end launch for Treasury clearing service

April 7, 2025 (NO COMMENTS)Third entrant expects Q2 comment period for new access models that address ‘done-away’ accounting hurdle

JPM leads record STWF surge at US G-Sibs

April 7, 2025 (NO COMMENTS)Five banks hit new highs in Q4, as increased reliance weighs on systemic risk scores

CFTC’s Doge-inspired drive to enforcement may fall short

April 7, 2025 (NO COMMENTS)Lawyers doubt guidance on rewards for self-reporting goes far enough

Tariffs volatility prompts rush to re-hedge EUR/USD options books

April 4, 2025 (NO COMMENTS)Banks left scrambling to buy vol as spot surged beyond expectations

Hedging playbook goes ‘out the window’ as Trump tariffs slam markets

April 4, 2025 (NO COMMENTS)Dispersion, put spreads and VKOs paid off as stocks plunged, but outlook remains wildly uncertain

Can Europe’s FRTB refurb bring banks back to Club IMA?

April 1, 2025 (NO COMMENTS)Softening the NMRF regime permanently might have the most impact, but the output floor still hurts

Rabobank jacks up climate risk overlays to loan provisions

April 1, 2025 (NO COMMENTS)Allowances top-up for chronic extreme weather increases more than sixfold

Corporates hamstrung in response to FX volatility

April 1, 2025 (NO COMMENTS)Restrictions around hedging programmes leave US firms struggling to adapt to dollar weakness

A peek under the hood of Canadian banks’ new CVA machine

March 25, 2025 (NO COMMENTS)Disclosures from the country’s top dealers offer first glimpse of how FRTB reforms can reshape capital gauge for potential losses on derivatives

AmEx derivatives book grows on interest rate swap surge

March 25, 2025 (NO COMMENTS)Receive-fixed swaps dominate hedging portfolio as clearing rate spikes

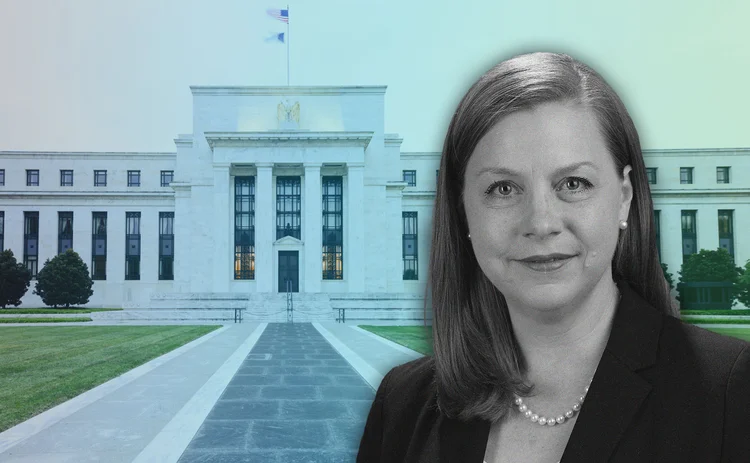

Bowman’s ascent sparks office intrigue at the Fed

March 25, 2025 (NO COMMENTS)Trump’s vice-chair for supervision pick is said to have a prickly relationship with Powell

Can Bessent lower 10-year yields? Investors have their doubts

March 24, 2025 (NO COMMENTS)Unconventional tools won’t sway bond markets, say buy-siders, with yields as likely to go higher as lower

NSCC suffers record $7bn liquidity shortfall

March 17, 2025 (NO COMMENTS)Index rebalancing in December drives CCP’s largest-ever simulated funding gap

Basel tweak may weaken counterparty hedging, industry warns

March 17, 2025 (NO COMMENTS)Proposed technical revision risks dissuading bespoke CDSs and guarantees covering derivatives exposures

CME-FICC cross-margin extension timeline questioned

March 17, 2025 (NO COMMENTS)SEC changes and queries around margin segregation may make end-2025 deadline unrealistic

Haidar Capital founder sees global yield curves steepening

March 17, 2025 (NO COMMENTS)‘Gigantic’ funding needs set to pressure long-dated European and US bonds

PTFs clash with banks over ‘done-away’ US Treasury clearing

March 14, 2025 (NO COMMENTS)Trading firms losing patience with banks’ reluctance to unbundle trading and execution

Credit fears drive US banks’ IRC requirements to 2022 highs

March 11, 2025 (NO COMMENTS)JP Morgan, BofA lead with triple-digit surge in Q4

Credit loss database reveals holes in Basel’s IRB formula

March 11, 2025 (NO COMMENTS)Researcher has used two decades of data to propose improved internal model methodology

Short-term Trump FX trades ‘dead’ as euro rallies

March 11, 2025 (NO COMMENTS)EUR/USD spot rally and vol spike sees mass unwinds of long USD trades

‘Trump slump’ hedges rise on rate cut fears

March 11, 2025 (NO COMMENTS)One dealer notes five-fold increase in number of clients hedging against possibility of faster rate cuts

Disappearing dealer gamma spurs wild stock swings

March 10, 2025 (NO COMMENTS)Stock market sell-off leaves dealers perilously close to peak short gamma positioning

Eurex squashes butterflies with Stir incentives

March 4, 2025 (NO COMMENTS)Rebate caps on low-risk strategies flatten mid-curve bulge in €STR contracts

Norinchukin’s repo retreat brings SFT exposures to four-year low

March 4, 2025 (NO COMMENTS)Japanese bank slashes gross SFT assets 54% in Q4, accelerating pullback from repo market to bolster capital

Shaking things up: geopolitics and the euro credit risk measure

March 4, 2025 (NO COMMENTS)Gravitational model offers novel way of assessing national and regional risks in new world order

Crypto custody a bit(coin) closer after US accounting U-turn

March 3, 2025 (NO COMMENTS)Federal banking supervisors expected to eventually relax regimes for safeguarding digital assets

Japan’s regulator stands firm behind Basel as peers buckle

March 3, 2025 (NO COMMENTS)Japanese banks fear being at a disadvantage to rivals as Basel III implementation falters

French banks’ equity VAR surges to multi-year highs

February 25, 2025 (NO COMMENTS)Volatility pushes fourth quarter readings at BNP Paribas, Crédit Agricole and SocGen to levels unseen in recent years

Value-at-risk models face neglect due to FRTB uncertainty

February 25, 2025 (NO COMMENTS)Some banks delaying material upgrades until timeline to replace VAR becomes clearer

Citi rolls out revamped SDP in emerging markets

February 25, 2025 (NO COMMENTS)Unified API will boost electronic pricing and automation for restricted currencies, says bank

Everything, everywhere: 15 AI use cases in play, all at once

February 25, 2025 (NO COMMENTS)Research is top AI use case, best execution bottom; no use is universal, and none shunned, says survey

CRR III hangs in the balance as member states push for changes

February 24, 2025 (NO COMMENTS)Top EU lawmaker rejects calls to water down capital rules, while others see room for manoeuvre

Dutch banks see mortgage loans sour in Q4

February 18, 2025 (NO COMMENTS)ABN Amro’s stage 2 mortgage ratio hits highest level since Covid-19 pandemic

AI and Trump tariffs spur hyped-up dispersion trade

February 18, 2025 (NO COMMENTS)Popular vol strategy pays off in January despite highest entry costs on record

Development banks team up for FX hedging push

February 18, 2025 (NO COMMENTS)Banks such as EBRD and World Bank club together to improve emerging market funding tools

Looming US Basel endgame redraft sparks calls to save IRB

February 18, 2025 (NO COMMENTS)Experts say 20 years of data makes credit risk models more appropriate than standardised approach

Esma climbs down on active account reporting rules

February 17, 2025 (NO COMMENTS)Industry in ‘wait-and-see mode’ after Löber comments suggest softer approach by EU regulator

Markets worry EU’s reporting simplification will add to burden

February 13, 2025 (NO COMMENTS)Rather than reducing firms’ obligations, market participants fear it could end up increasing requirements

How Citi moved GenAI from firm-wide ban to internal roll-out

February 13, 2025 (NO COMMENTS)Bank adopted three specific inward-facing use cases with a unified framework behind them

Big banks could be sidelined from future rescue deals – FSB

February 10, 2025 (NO COMMENTS)Exacerbation of too-big-to-fail means G-Sibs could already be too large to take extra assets

How a serverless risk engine transformed a digital bank

February 7, 2025 (NO COMMENTS)Migrating to the cloud permitted scalability, faster model updates and a better team structure

Cross-border lending to shadow banks spiked in Q3

February 7, 2025 (NO COMMENTS)Non-bank financial institutions record fastest annual growth since Covid-19 pandemic

Buffer stop: Eurex clearing members shunt default fund

February 7, 2025 (NO COMMENTS)Clearing house’s CRO says both members and clients opt to pay more margin instead

Funds tap options on FX vol amid tariff disruptions

February 6, 2025 (NO COMMENTS)Dealers say vanillas, digitals and knockouts on realised vol increasingly used to navigate Trump news flow

Crossed signals: row over collusion pits scholars against traders

February 6, 2025 (NO COMMENTS)An Oxford study claims to show evidence of collusion in ETF markets. Some traders give it short shrift.

TD’s prop-style trading shop rises up bond rankings

February 4, 2025 (NO COMMENTS)Ascent of bank’s bond trading business comes amid electronification changes in US fixed income market structure

Morgan Stanley overtakes BofA as third-largest FCM by margin in 2024

January 28, 2025 (NO COMMENTS)Marex and Deutsche see sharpest upticks in required client margin for F&O, while Wedbush and Mizuho fall furthest

Why JP Morgan’s Santos wants to make bad news travel fast

January 28, 2025 (NO COMMENTS)Asset management CRO says sharing information early holds the key to avoiding surprises

Iosco pre-hedging review: more RFQs than answers

January 28, 2025 (NO COMMENTS)Latest proposals leave observers weighing new clampdown on pre-hedging

‘Street Fighter’ Sef RTX grows in interdealer swaps market

January 27, 2025 (NO COMMENTS)Focus on functionality and fees helped volumes on start-up venue from Cawley and Jonns jump fivefold last year

How UBS sold off non-core equity assets at lightning speed

January 27, 2025 (NO COMMENTS)More than 40 auctions have been completed since Credit Suisse acquisition, with a little help from a T-Rex

Overcoming Markowitz’s instability with hierarchical risk parity

January 24, 2025 (NO COMMENTS)Portfolio optimisation via HRP provides stable and robust weight estimates

CPMI-Iosco report highlights gaps in CCPs’ variation margin practices

January 24, 2025 (NO COMMENTS)Survey finds only a third implement VM pass-through, just 15% net client and house accounts

Housing price diffusion study offers lessons for quants – Bouchaud

January 24, 2025 (NO COMMENTS)Patterns seen in how heat spreads also show up in markets, research shows

BoE warns over risk of system-wide cyber attack

January 23, 2025 (NO COMMENTS)Senior policy official Carolyn Wilkins also expresses concern over global fragmentation of bank regulation

Stuck in the middle with EU: dealers clash over FRTB timing

January 23, 2025 (NO COMMENTS)Largest banks want Commission to delay implementation, but it’s not the legislator’s only option

Op risk data: Mastercard schooled in £200m class action

January 20, 2025 (NO COMMENTS)Also: Mitsubishi copper crunch, TD tops 2024 op risk loss table. Data by ORX News

Euro swap spread volatility challenges Bund’s hedging role

January 20, 2025 (NO COMMENTS)German Bunds face scrutiny as euro swap spreads turn negative, forcing traders to rethink hedging strategies

Member contributions propel six default funds to new highs

January 20, 2025 (NO COMMENTS)Skin in the game unchanged at four CCPs amid $3bn rise in default resources

Australian FRTB projects slow down amid scheduling uncertainty

January 20, 2025 (NO COMMENTS)Market risk experts think Apra might soften NMRF regime to spur internal model adoption

Bloomberg offers auto-RFQ chat feed – but banks want a bigger prize

January 17, 2025 (NO COMMENTS)Traders hope for unfettered access to IB chat so they can build their own AI-enhanced trading tools

Funding arbitrages and optimal funding policy

January 14, 2025 (NO COMMENTS)Stochastic control can be used to manage a bank’s net asset income

Basel stops short on wrong-way risk

January 14, 2025 (NO COMMENTS)New guidelines a step in right direction, but experts warn they won’t prevent another Archegos

TD Bank’s annual op loss tab surges 144% amid AML settlement

January 14, 2025 (NO COMMENTS)US plea deal drives bank’s op RWAs to record C$120 billion

Amazon, Meta and Tesla reject FX hedging

January 14, 2025 (NO COMMENTS)Risk.net study shows tech giants don’t hedge day-to-day exposures

China finalises IM rules but gaps remain

January 13, 2025 (NO COMMENTS)Largest banks and insurers must start posting from 2027, but details for securities houses are yet to appear

Risk.net’s top 10 investment risks for 2025

January 6, 2025 (NO COMMENTS)Trade wars, a stock market crash, strikes and riots, political violence: buy-siders share their fears as the year begins

Margin breaches skyrocket at JSCC amid market volatility

January 6, 2025 (NO COMMENTS)August turmoil led to record initial margin shortfalls at six clearing divisions

Global banks boost Level 3 assets to new highs

January 3, 2025 (NO COMMENTS)European lenders and UBS-Credit Suisse merger fuelled rise in hard-to-value instruments in 2023

Capital neutrality key to completing Basel III, says Quarles

January 3, 2025 (NO COMMENTS)Former Republican Fed vice-chair thinks Hill or Bowman could help revive stalled prudential rules

For banks, change risk is inevitable; managing it, optional

January 3, 2025 (NO COMMENTS)Regional bank survey shows steady growth of dedicated change risk functions and adoption of leading indicators

Clearing members ponder the purpose of CME’s mystery FCM

January 2, 2025 (NO COMMENTS)Some think licence will be used to boost crypto clearing capacity, but many questions remain

Record share of OTC trades eschews interdealer, CCP channels

January 2, 2025 (NO COMMENTS)More than one-fourth of global notional involves a single dealer and is not cleared, BIS data shows

EU IMA users maintain edge in keeping risk charges compressed

December 31, 2024 (NO COMMENTS)Aggregate market RWAs increased slower in 12 months to June than at banks using SA only

Cboe plans Q2 dispersion futures listing

December 30, 2024 (NO COMMENTS)Expectations of post-US-election uncertainty drives launch, and could help bank equity desks hedge OTC risks

Dora flood pitches banks against vendors

December 24, 2024 (NO COMMENTS)Firms ask vendors for late addendums sometimes unrelated to resiliency, requiring renegotiation

Pimco and Vanguard slash FX forwards trading with BNP Paribas

December 24, 2024 (NO COMMENTS)

G-Sib cross-border risk drops to four-year low

December 23, 2024 (NO COMMENTS)Two-thirds of systemic banks saw systemic indicator decrease in 2023

Profit and pain as macro turmoil engulfs Brazil

December 23, 2024 (NO COMMENTS)FX options trades pay off, while sharp jump in rates caught traders by surprise

CME to launch single-stock futures

December 16, 2024 (NO COMMENTS)Exchange will focus on ‘Mag 7’ tech names after rivals fail with broader offerings

Quantum two-sample test for investment strategies

December 16, 2024 (NO COMMENTS)Quantum algorithms display high discriminatory power in the classification of probability distributions

Credit risk transfer, with a derivatives twist

December 16, 2024 (NO COMMENTS)Dealers angle to revive market that enables them to offload counterparty exposures, freeing up capital

Fed’s stricter G-Sib scoring punishes BofA, Goldman

December 16, 2024 (NO COMMENTS)Duo’s method 2 capital requirements will diverge further from those entailed by Basel’s methodology

Acadian model detects gaps between climate goals and reality

December 16, 2024 (NO COMMENTS)Quant shop builds tool for net-zero alignment assessment, using NLP and Bayesian models

BofA’s rates revamp leans into multi-strategy boom

December 11, 2024 (NO COMMENTS)Collateral efficiency, e-trading and central risk book prioritised in enlarged rates, futures and financing unit

Goldman chalks up highest VAR breach since pandemic

December 11, 2024 (NO COMMENTS)

Banks feel regulatory heat on op resilience

December 11, 2024 (NO COMMENTS)Op Risk Benchmarking: supervisors dial up reporting expectations and on-site inspections as Dora and UK regime deadlines approach

Nomura’s HQLAs hit record ¥7.1 trillion

December 10, 2024 (NO COMMENTS)Notes issuance, favourable yen boost easy-to-sell reserves

China’s snowballs hit by new regulatory clampdown

December 10, 2024 (NO COMMENTS)Restrictions on structured note issuance by securities houses blocks key distribution channel

Snap! Derivatives reports decouple after Emir Refit shake-up

December 4, 2024 (NO COMMENTS)Counterparties find new rules have led to worse data quality, threatening regulators’ oversight of systemic risk

New CME guidance to drive tighter margin call management

December 3, 2024 (NO COMMENTS)Clearing house rule clarified to limit the use of grace periods to cases of admin/operational errors only

Barclays dethrones JP Morgan as largest OTC derivatives dealer

December 3, 2024 (NO COMMENTS)UK bank’s notionals surged 12.6% to $49 trillion in 2023, G-Sib indicators show

Too ’Berg to fail? What October’s Instant Bloomberg outage means for the industry

December 2, 2024 (NO COMMENTS)The ubiquitous communications platform is vital for traders around the globe, especially in fixed income and exotic derivatives. When it fails, the disruption can be great

Critics warn against softening risk transfer rules for insurers

December 2, 2024 (NO COMMENTS)EU proposal to cut capital for unfunded protection of bank loan books would create systemic risk, investors say

Eleven of 14 G-Sib indicators hit all-time highs

November 27, 2024 (NO COMMENTS)Surging complexity marked 2023, tempered by slower gains overall

Crédit Agricole headed for 1.5% G-Sib surcharge in 2026

November 26, 2024 (NO COMMENTS)French bank’s surging G-Sib score puts it past Deutsche in latest systemic risk assessment

Robeco fires up AI thematic ETF

November 26, 2024 (NO COMMENTS)Firm’s large language models pick themes, categorise stocks, and choose winners and losers

Barr defends easing of Basel III endgame proposal

November 20, 2024 (NO COMMENTS)Fed’s top regulator says he will stay and finish the package, is comfortable with capital impact

Finma add-on drives UBS’s market RWAs to eight-year high

November 18, 2024 (NO COMMENTS)Swiss regulator adds $1.4bn to mitigate maturity mismatch risk within IRC

The wisdom of Oz? Why Australia is phasing out AT1s

November 18, 2024 (NO COMMENTS)Analysts think Australian banks will transition smoothly, but other countries unlikely to follow

New climate inputs upset Commerz’s loan risk map

November 18, 2024 (NO COMMENTS)Integration of sustainability parameters into provision models shifts €16 billion of loans to stage 2

EU bonds favoured over swaps as hedge for European debt

November 15, 2024 (NO COMMENTS)Hedge funds are increasingly using the bonds to hedge Bunds and OATs as swap correlations decline

Canada benchmark shaken by T+1 hedge fund influx

November 14, 2024 (NO COMMENTS)Shortened settlement cycle swept hedge fund trades into Corra, making the rate more volatile

India delays IM go-live date

November 13, 2024 (NO COMMENTS)RBI communicated putting off initial margin rules one day before planned November 8 implementation

Barclays and HSBC opt for FRTB internal models

November 11, 2024 (NO COMMENTS)However, UK pair unlikely to chase approval in time for Basel III go-live in January 2026

CFTC’s Mersinger wants new rules for vertical silos

November 8, 2024 (NO COMMENTS)Republican commissioner shares Democrats’ concerns about combined FCMs and clearing houses

Talking Heads 2024: All eyes on US equities

November 8, 2024 (NO COMMENTS)How the tech-driven S&P 500 surge has impacted thinking at five market participants

Hedge funds take profit on vol trades with Trump win

November 8, 2024 (NO COMMENTS)FX volatility drops sharply as positions unwind; rates market sees mixed reaction

Neil Chriss sets out to codify the game theory of trading

November 8, 2024 (NO COMMENTS)The co-author of the benchmark Almgren-Chriss model has updated his thinking on market impact

Knives out: LME court cases cleave apart creditor expectations

November 8, 2024 (NO COMMENTS)Diverging court rulings show pitfalls and potential of challenging controversial transactions

StanChart’s market RWAs hits eight-year high

November 8, 2024 (NO COMMENTS)Client-driven RWA deployment raises market risk exposure by $3.2 billion

More cleared repo sponsors join Eurex ahead of cross-margining

November 4, 2024 (NO COMMENTS)End of TLTROs for banks and pension fund search for liquidity management tools drives uptake

Hedge funds pile into short volatility QIS options

November 4, 2024 (NO COMMENTS)New twist on capturing vol premium remains popular despite mixed performance in August vol spike

Breaking market norms, tri-party repo rates plunge for fringe collateral

November 4, 2024 (NO COMMENTS)Yields hierarchy upended as cost of repo-ing equities and other volatile securities falls over a percentage point below UST repos

Republican SEC may focus on fixed income – Peirce

November 4, 2024 (NO COMMENTS)Commissioner also wants a revival of finders’ exemption, more guidance for UST clearing

Exotic FX derivatives bets in play as US election vol jumps

November 1, 2024 (NO COMMENTS)Forward volatility agreements see profits for funds; new trades include vol knockouts

CME files application for US Treasury and repo clearing

October 29, 2024 (NO COMMENTS)New entrant believes pure agency model will avoid accounting problem that hampers rival FICC

US primary dealers mark largest settlement failures to date under T+1

October 29, 2024 (NO COMMENTS)Hung-trade volumes hit highest in two years at the end of September

New benchmark to give Philippine peso swaps a fillip, post-Isda add

October 29, 2024 (NO COMMENTS)Isda to include new PHP overnight rate and Indonesia’s Indonia in its next definitions update

Physical climate risk threatens 15% of EU banks’ property loans

October 28, 2024 (NO COMMENTS)Erste, Helaba, BPCE most exposed to chronic and acute risks linked to climate change

Boeing’s descent to junk doesn’t scare investors

October 28, 2024 (NO COMMENTS)Analysts and managers say market can absorb any selling pressure from potential downgrade

Clearing houses fear being classified as Dora third parties

October 23, 2024 (NO COMMENTS)As 2025 deadline looms, CCP and exchange members seek risk information that’s usually deemed confidential

Time running out to backload Emir derivatives reporting

October 23, 2024 (NO COMMENTS)Significant slice of legacy trades still not ready for new formats, as October 26 deadline looms

A comparison of FX fixing methodologies

October 23, 2024 (NO COMMENTS)FX fixing outcomes are mostly driven by length of calculation window

KeyCorp refreshes AFS portfolio with $7bn CMBS sale

October 23, 2024 (NO COMMENTS)Strategic shift taps peak valuations and Scotiabank investment to reduce AOCI pressure

Rates movements boost FX net investment hedging

October 22, 2024 (NO COMMENTS)Changing differentials bring more positive carry opportunities for corporates

August’s volatility thunderbolt rattles risk managers

October 17, 2024 (NO COMMENTS)Investment firms mull changes to value-at-risk models after never-before-seen spike in volatility index

How the rate hike cycle emboldened banks’ deposit modelling

October 17, 2024 (NO COMMENTS)But just because depositors didn’t react quickly doesn’t mean it will never happen

JPM, PNC bolster available-for-sale portfolios in Q3

October 17, 2024 (NO COMMENTS)Four major US banks add $119bn to AFS holdings

Are investors betting on Kamala or Donald? Neither

October 17, 2024 (NO COMMENTS)Hedge funds and others shun election-based trades and rely on existing hedges to guard against surprise market moves

SEC’s Peirce calls for US Treasury clearing delay

October 16, 2024 (NO COMMENTS)Risk Live: Current timeline impractical, commissioner warns; proposes task force to steer implementation

Netting hurdles could decide the US Treasuries clearing race

October 16, 2024 (NO COMMENTS)Competing CCPs must resolve accounting and cross-margining obstacles to benefit from SEC mandate

US jobs shock leads to steepener unwinds

October 11, 2024 (NO COMMENTS)Investors take profit after October employment report leads to flattening moves

Can pod shops channel ‘organisational alpha’?

October 11, 2024 (NO COMMENTS)The tension between a firm and its managers can drag on returns. So far, there’s no perfect fix

Nine jurisdictions yet to finalise Basel III rules

October 11, 2024 (NO COMMENTS)Turkey and South Africa worst laggards, with no final drafts published

BNP Paribas exec fears data drought from market’s IMA cuts

October 10, 2024 (NO COMMENTS)Vendors may not step up with critical inputs to support internal models under FRTB

UBS embraces ‘narrative alpha’ for new form of sentiment strategy

October 10, 2024 (NO COMMENTS)NLP engine traces how stories spread, instead of counting words

FDIC’s McKernan wants single capital stack in Basel III endgame

October 8, 2024 (NO COMMENTS)Rebuffing Barr’s offer of a partial rollback, Republican director also targets op risk framework

Climate stress tests are cold comfort for banks

October 7, 2024 (NO COMMENTS)Flaws in regulators’ methodology for gauging financial impact of climate change undermine transition efforts, argues modelling expert

EquityClear’s IM concentration hits record high

October 7, 2024 (NO COMMENTS)Membership dwindles as LCH SA continues to wind down service

Simm casts off Covid pain for $40 billion IM reprieve

October 3, 2024 (NO COMMENTS)Recalibration cuts risk weights in equity and commodities, but some credit exposures double on ABX halt

Inside Nomura’s European equities rebuild

October 3, 2024 (NO COMMENTS)Talking Heads: Global chief Simon Yates also addresses US crowding and Japan’s prospects post-carry trade

Fed relief plan for G-Sib agency clearing welcomed

September 30, 2024 (NO COMMENTS)Rollback may revive interest in European FCM model, as principal clearing still treated punitively

SocGen closest to TLAC minimum among G-Sibs

September 30, 2024 (NO COMMENTS)Gap between bail-in funds and required amounts narrows at Canadian lenders; Wells Fargo buffer smallest in US

Indian initial margin launch brings operational headaches

September 30, 2024 (NO COMMENTS)Conglomerates with multiple entities trading derivatives pose compliance challenges for dealers

Accounting fix needed for done-away Treasury clearing – DTCC

September 27, 2024 (NO COMMENTS)Splitting UST execution and clearing “not viable” for clearing brokers under current regime

Fed’s new liquidity rule spells more pain for regional banks

September 26, 2024 (NO COMMENTS)Limit on HTM assets follows move to deduct unrealised losses from capital buffers

Cable basis set to shrink as pension buyouts dwindle

September 24, 2024 (NO COMMENTS)BoE rate cuts and tightening US credit spreads expected to further normalise the sterling-US dollar cross-currency basis

JPM’s EU arm outpaced bloc’s top dealers on OTC derivatives in 2023

September 24, 2024 (NO COMMENTS)A 30% surge in notionals coincided with a departure from central clearing

Clearing members welcome JSCC initial margin reforms

September 24, 2024 (NO COMMENTS)Stress loss add-ons touted as path to ensure defaulter pays and default fund contributions shrink

Supply chain decoupling fires up alpha focus at BofA

September 23, 2024 (NO COMMENTS)Talking Heads: Stock dispersion sees funds gross up on long/short baskets, while US structured notes come of age

Pricing and funding pressures hit gilt repo dealers

September 20, 2024 (NO COMMENTS)QT-driven funding cost rises combined with clients’ price demands see at least two banks pull back

EU banks fear loss of NSFR relief for repo trades

September 19, 2024 (NO COMMENTS)European Commission must decide by next June; other jurisdictions adopted softer calibration

Backtesting correlated quantities

September 18, 2024 (NO COMMENTS)A technique to decorrelate samples and reach higher discriminatory power is presented

Could Trump presidency herald $27bn margin call on World Bank?

September 18, 2024 (NO COMMENTS)Think-tank’s policy plan to pull US out of multilateral threatens AAA rating, ending collateral exemption

UBS Americas’ clearing rate dips post Credit Suisse integration

September 18, 2024 (NO COMMENTS)US arm of Swiss bank cleared $47bn in notionals in the second quarter, the lowest since end-2021

New data reveals Pimco is top Ucits interest rate swaps user

September 18, 2024 (NO COMMENTS)Counterparty Radar: US managers and dealers reign supreme in European retail fund space

Endgame manoeuvre: US banks put SLR reform back in spotlight

September 17, 2024 (NO COMMENTS)Plan to ease Basel III brings renewed focus to impact of leverage ratio on US Treasury market

UBS Americas’ delinquent mortgages up sixfold post Credit Suisse merger

September 10, 2024 (NO COMMENTS)Share of delinquent exposures jumps to 1.2% of bank’s total real estate loan portfolio

FX data champion outlines transparency push

September 10, 2024 (NO COMMENTS)Stuart Simmons, new head of GFXC working group, wants trading platforms to come clean on how they use client data

FICC captures record share of US MMF repos

September 9, 2024 (NO COMMENTS)Fed facility sees continued outflows as funds redirect assets

ETF dispersion set for election revival

September 9, 2024 (NO COMMENTS)Sector-based approach to popular vol trades boasts cheaper entry cost than classic version, proponents argue

The post-Archegos risk model rebuild begins…slowly

September 4, 2024 (NO COMMENTS)Following regulatory prodding, banks start to overhaul counterparty risk models. A flurry of new research on the topic may aid the effort

Nykredit reclassifies Dkr70bn of credit risk to A-IRB

September 4, 2024 (NO COMMENTS)Reserves held in anticipation of upcoming regulatory requirements transferred from F-IRB approach in Q2

New CRE model adds $1.8bn to UBS’s RWAs

September 3, 2024 (NO COMMENTS)Swath of exposures moved from standardised to IRB approach in the second quarter

Jane Street ups its game in FX market-making

September 3, 2024 (NO COMMENTS)High-frequency trading firm now streaming bilateral spot FX liquidity to clients

Let’s grow the third-party risk playbook – CME security chief

September 2, 2024 (NO COMMENTS)CrowdStrike outage highlights need for financial sector to adjust its game plan

Deutsche curbs CVA charges to record low

September 2, 2024 (NO COMMENTS)Addition of hedges in Q2 helps cut RWAs by 26%, outpacing other European banks

NAIC wants more disclosure about use of offshore reinsurance

August 30, 2024 (NO COMMENTS)CrowdStrike outage highlights need for financial sector to adjust its game plan

Pre-market trades blamed for record Vix surge

August 29, 2024 (NO COMMENTS)Traders rushed to cover short volatility positions before the market opened on August 5

Some EU banks wanted option to start FRTB on time

August 20, 2024 (NO COMMENTS)Representatives of member states had raised possibility with EC at a July meeting discussing the delay

FX algo users change tack to navigate market doldrums

August 20, 2024 (NO COMMENTS)BestX data finds traders ditching TWAP in favour of more opportunistic execution styles

For US Treasury troubles, treat the cause not the symptom

August 19, 2024 (NO COMMENTS)Regulatory alarm about hidden risk in the Treasury futures market misses the point, fund association execs write

Study finds just 10 banks plan to apply for FRTB models

August 18, 2024 (NO COMMENTS)Research provides extra insight on reasons for decline in internal models

Bankers hope EBA op risk taxonomy will go global

August 18, 2024 (NO COMMENTS)Proposed update to 20-year-old risk map is welcomed, but international co-ordination urged

Sliced and sliced again: investors’ latest trick for risk transfer

August 14, 2024 (NO COMMENTS)‘Retranched’ synthetic securitisations offer higher yields, but questions remain over legality of structures

Banks cry foul over shock decision from Basel Committee

August 11, 2024 (NO COMMENTS)Asset and liability management professionals question severity of criteria in revised IRRBB tests

Margin calls jumped threefold as global markets sold off

August 9, 2024 (NO COMMENTS)FCMs claim no client defaults, but episode revives complaints of procyclical margining

Bitcoin ETFs drive demand for borrowing in crypto markets

August 9, 2024 (NO COMMENTS)Mismatch between cash and crypto settlement cycles creates pre-funding challenge

Honey, I shrunk the Fed. (Not a sci-fi fantasy)

August 9, 2024 (NO COMMENTS)Promoting the discount window may be the Fed’s key to shrinking its $7trn balance sheet, says Bill Nelson

LCR drops to multiyear lows at OCBC, UOB

August 9, 2024 (NO COMMENTS)Higher wholesale funding outflows partly responsible for reduction in liquidity ratios

Between the lines: why banks are rethinking risk management

August 1, 2024 (NO COMMENTS)Lloyds is not the only bank wanting to reshuffle the three lines of defence as tech risks grow

NatWest securitisation RWAs hit record high in Q2

August 1, 2024 (NO COMMENTS)NatWest Group’s risk-weighted assets (RWAs) stemming from securitisation exposures not in the trading book rose by 14.3% in the second quarter,

IDB to expand contingent swap scheme in Latin America

July 31, 2024 (NO COMMENTS)New mechanism gives regional development banks cheaper FX rates with hedges linked to credit events

Long shadow of Apollo looms over turmoil at Athora

July 31, 2024 (NO COMMENTS)ascenteum investigation reveals troubling picture of US asset manager’s European insurance project

AFS securities sale costs Truist $6.8bn

July 31, 2024 (NO COMMENTS)Purge of investment securities marks largest single-quarter loss by a US bank in 10 years

Hedge funds pile into euro systematic gamma selling

July 30, 2024 (NO COMMENTS)Range-bound rates markets in Europe entice hedge funds to sell short-dated straddle positions

Corporates look to collars amid rates uncertainty

July 16, 2024 (NO COMMENTS)Selling the floor can cover majority of cap’s premium

EU banks hedge net interest income to pass new IRRBB test

July 16, 2024 (NO COMMENTS)Would-be outliers look to cut sensitivity of cashflows to rate moves, but at what cost?

DCOs show resilience beyond key default thresholds – CFTC

July 16, 2024 (NO COMMENTS)Reverse stress test reveals clearing houses remain resilient under low to moderate market shocks

Capital Group grows interest rates swaps book by 62%

July 16, 2024 (NO COMMENTS)Counterparty Radar: Aggregate notional of US mutual fund and ETF positions hit $957 billion in Q1

Can Citi’s XVA desk help solve risk data failings?

July 15, 2024 (NO COMMENTS)Resolution plan reviews exposed material limitations in banks’ ability to unwind derivatives

Discord deepens over fund-linked trades in FRTB

July 8, 2024 (NO COMMENTS)More banks use punitive approach to capital treatment under new trading book regime, irking regulators

Could the SEC revive the private fund adviser rule?

July 5, 2024 (NO COMMENTS)Industry experts deem a second life for the reviled rule unlikely

How a ‘sushi circle’ approach can improve credit risk management

July 5, 2024 (NO COMMENTS)AI can help banks shift from manual corporate loan reviews to continuous, digitised risk monitoring

HSBC North America breached leverage ratio minimum in latest DFAST

July 5, 2024 (NO COMMENTS)Ratio of UK bank’s US subsidiary ended stress test 20 basis points below regulatory threshold

Five battle for euro swaps clearing

July 4, 2024 (NO COMMENTS)Nasdaq aims to be regional hub, while BME seeks broader slice of ‘active accounts’ pie

CIBC’s VAR hits highest since 2008 amid interest rate risk surge

June 28, 2024 (NO COMMENTS)Client and market-making activities responsible for 44% increase

Securitisation clears way for UK insurers to buy ground rents

June 28, 2024 (NO COMMENTS)Asset manager says booming sector will make up for falling demand from pensions

US Fed reveals its five use cases for generative AI

June 27, 2024 (NO COMMENTS)Internal sandbox used to assess viability and risks; coding and content generation on the agenda

US banks seek to open vendors’ black box on green data

June 25, 2024 (NO COMMENTS)Inaugural Fed climate scenario analysis flags lack of transparency around third-party models

Model teams fear budget cuts as FRTB wipeout looms

June 17, 2024 (NO COMMENTS)Senior modellers think supervisory intervention is needed to prevent funding drought

Liquidity risk hits five-year high at LCH

June 17, 2024 (NO COMMENTS)Higher settlement obligations at Paris-based RepoClear blamed for €9bn spike

Capital rules explain leverage craving in US bank risk transfers

June 17, 2024 (NO COMMENTS)Tougher requirements have led to conservative structuring and lower coupons

Euribor fills panel gaps with Finland and Greece

June 14, 2024 (NO COMMENTS)OP Corporate Bank and NBG take contributors to 21 as administrator switches off “expert judgement”

Non-deliverable CNY swaps defy doubters

June 14, 2024 (NO COMMENTS)Swap Connect’s launch has helped rather than hindered the instrument, say dealers

Shocks to the system: how Basel IRRBB update affects new EU test

June 11, 2024 (NO COMMENTS)Disclosures suggest more banks will be classified as outliers on net interest income assessment

Loss of diversification benefits ‘will drive higher FRTB charges’

June 10, 2024 (NO COMMENTS)Independent study backs industry’s claims of significant rise in market risk capital requirements

New CDS index delayed by regulatory capital concerns

June 7, 2024 (NO COMMENTS)Dealer worries about impact of self-referencing trades derail CDX Financials launch at last minute

Drilling for default: dry run gives CCPs a Lehman-like lesson

June 6, 2024 (NO COMMENTS)Member default simulation finds standardisation and porting could help in a crisis, and moots unscheduled repeat drill

Breaking with Behnam: inside the dysfunction at the CFTC

June 4, 2024 (NO COMMENTS)Policy and personality clashes have left the chairman isolated and slowed rulemaking activity to a crawl

Citi tops second edition of Risk’s Dealer Rankings

May 24, 2024 (NO COMMENTS)Dealer Rankings 2024: Data shows five big US dealers still lead, but with Europeans closing in

FX futures momentum challenges primary venues’ pricing role

May 24, 2024 (NO COMMENTS)Panellists suggest spot FX primary markets’ importance in models has “diminished”

T+1 shift sparks dividend chaos in HK structured products

May 24, 2024 (NO COMMENTS)Products staying on T+2 leave providers scrambling to deal with ex-dividend dates caught inbetween

OCC introduces new intraday risk charge covering zero-day options

May 23, 2024 (NO COMMENTS)Revised measures “a nightmare” to implement, says one broker-dealer

Basel triggers new tussle on anti-Archegos rules

May 20, 2024 (NO COMMENTS)Critics argue new guidelines on counterparty credit risk are either unworkable, or don’t go far enough to tackle concentration and wrong-way risk

FRTB start dates must align globally, says EC

May 17, 2024 (NO COMMENTS)Lawmaker could trigger delay to market risk rules in Europe if US implementation drags on

Basel III endgame: why moving fast might prove better for banks

May 15, 2024 (NO COMMENTS)Republicans are pushing for reproposal, but a rapid finalisation may prove less far-reaching

Basel war on window-dressing may smooth liquidity, at a price

May 14, 2024 (NO COMMENTS)Changes to G-Sib charge could curb year-end repo volatility, but also cut balance sheet capacity

HSBC, StanChart SVAR charges hit multi-year highs

May 14, 2024 (NO COMMENTS)Stressed trading-loss measure makes up 43% of banks’ modelled market risk charges

MassMutual adds to mammoth interest rate swaps book

May 14, 2024 (NO COMMENTS)Counterparty Radar: Firm was responsible for 28% of US life insurers’ notional volume in Q4 2023

Napier Park to increase investment in bank risk transfers

May 13, 2024 (NO COMMENTS)Hedge fund sees secular trend in lenders offloading credit risk, and plans to be part of it

Clear warning on escape hatch for optimisation trades

May 13, 2024 (NO COMMENTS)CCPs fear Emir clearing mandate carve-out for portfolio rebalancing could be abused

Execs can game sentiment engines, but can they fool LLMs?

May 7, 2024 (NO COMMENTS)Quants are firing up large language models to cut through corporate blather

How Man Group’s private credit arm keeps risk in check

May 3, 2024 (NO COMMENTS)Mid-market lending no place for weak covenants, flexible addbacks or payments in kind, says Varagon CEO

End of BTFP curtails Comerica’s contingent funding pool

May 3, 2024 (NO COMMENTS)Decision not to take avail of facility’s paper-loss amnesty showcases US regional banks’ conundrum

False start: 13 EU banks miscalculate new GAR coverage metric

May 2, 2024 (NO COMMENTS)Unclear instructions, late guidance and poor font choices among reasons behind diverging interpretations from EBA’s template

Nervous UK pension schemes want liquidity fixes – it’ll cost them

May 2, 2024 (NO COMMENTS)Asset managers are crafting new ways for schemes to raise cash in a crisis

Op risk hits all-time highs at three Nordic banks

May 1, 2024 (NO COMMENTS)Regular updates drive record rises at Handelsbanken, Nordea and SEB

FCA presses UK non-banks to put their affairs in order

April 23, 2024 (NO COMMENTS)Greater scrutiny of wind-down plans by regulator could alter capital and liquidity requirements

BNY Mellon dips below Collins floor after surge in standardised RWAs

April 23, 2024 (NO COMMENTS)All nine US banks using internal models now bound by regulator-set approach

Liquidnet sees electronic future for grey bond trading

April 23, 2024 (NO COMMENTS)TP Icap’s grey market bond trading unit has more than doubled transactions in the first quarter of 2024

HSBC, Intesa incorporate 2022–23 downturn into SVAR models

April 22, 2024 (NO COMMENTS)Turbulent past two years implied to be worse than GFC in stressed simulations

FICC takes flak over Treasury clearing proposal

April 22, 2024 (NO COMMENTS)Latest plans would still allow members to bundle clearing and execution – and would fail to boost clearing capacity, critics say

How ‘re-correlation’ risk could cause a pod-shop unwind

April 22, 2024 (NO COMMENTS)Some think an underappreciated vulnerability might one day lead to a 2008-type crisis

Citi halves swaptions book with US retail funds

April 19, 2024 (NO COMMENTS)Counterparty Radar: Mutual funds and ETFs cut exposures by 22% in Q4

Ice Europe’s liquidity risk at record high in Q4

April 19, 2024 (NO COMMENTS)Estimated largest payment obligation in euros more than double previous quarter’s figure

CDS review seeks to tackle conflicts ‘elephant’

April 18, 2024 (NO COMMENTS)Isda AGM: Linklaters unveils key recommendations for CDS committee overhaul

Industry calls for major rethink of Basel III rules

April 18, 2024 (NO COMMENTS)Isda AGM: Divergence on implementation suggests rules could be flawed, bankers say

Japanese megabanks shun internal models as FRTB bites

April 17, 2024 (NO COMMENTS)Isda AGM: All in-scope banks opt for standardised approach to market risk; Nomura eyes IMA in 2025

CFTC chair backs easing of G-Sib surcharge in Basel endgame

April 17, 2024 (NO COMMENTS)Isda AGM: Fed’s proposed surcharge changes could hike client clearing cost by 80%

Options market still searching for cause of the Vix plunge

April 12, 2024 (NO COMMENTS)BIS paper blames yield-enhancing structured products, but market participants are unconvinced

Green knights? Banks step into struggling carbon credit markets

April 12, 2024 (NO COMMENTS)Clearer global standards and a new exchange may attract dealer entry, but supply and demand challenges remain

LCH issued highest cash call in more than five years

April 12, 2024 (NO COMMENTS)Largest same-day payment obligation triples in Q4 2023

Filling gaps in market data with optimal transport

April 11, 2024 (NO COMMENTS)Julius Baer quant proposes novel way to generate accurate prices for illiquid maturities

Pension schemes prep facilities to ‘repo’ fund units

April 11, 2024 (NO COMMENTS)Schroders, State Street and Cardano plan new way to shore up pension portfolios against repeat of 2022 gilt crisis

The American way: a stress-test substitute for Basel’s IRRBB?

April 11, 2024 (NO COMMENTS)Bankers divided over new CCAR scenario designed to bridge supervisory gap exposed by SVB failure

As dispersion hikes in price, equity traders slice and dice

April 10, 2024 (NO COMMENTS)Banks tout alternative versions of relative value vol strategy, including reverse dispersion

Doubts dog equity dispersion as market grows up to five-fold

April 8, 2024 (NO COMMENTS)Some say $500 million vega notional – or more – in popular equity derivatives trades could be dampening volatility

Japanese banks’ leverage ratios keep rising as BoJ relief becomes permanent

March 28, 2024 (NO COMMENTS)Norinchukin reaps largest benefit on eve of Covid-19-era exemption being made permanent

The signs of tacit collusion in the dividend play trade

March 28, 2024 (NO COMMENTS)Game theory and real-world data point to a different understanding of how arbitrage in markets works

Regulatory crackdown puts Korea autocalls in deep freeze

March 28, 2024 (NO COMMENTS)Mis-selling fears see distributors pull back, leading to 40% fall in issuance in a month

Top 10 operational risks for 2024

March 27, 2024 (NO COMMENTS)The biggest op risks for the year ahead, as chosen by senior industry practitioners

‘No frowning’ on banks for discount window borrowing – Fed official

March 27, 2024 (NO COMMENTS)Risk Live: more banks have completed paperwork to access Fed lending facility than a year ago

RMB vol returns as hedge funds take barrier trade profits

March 25, 2024 (NO COMMENTS)Unwinds of exotic positions saw vol jump 72% after surprise PBoC move last week

Brazil readies long-dated FX hedging scheme for green projects

March 21, 2024 (NO COMMENTS)Development bank IDB will lend its credit rating to unlock cheaper USD/BRL hedges out to 25 years

Foreign buyers jolt e-trading in Japan government bonds

March 20, 2024 (NO COMMENTS)Platforms report rise in small-ticket volumes, but bigger trades remain on voice

Esma faces tough task in implementing Emir 3.0

March 20, 2024 (NO COMMENTS)EU regulator must contend with tight timeframes and increasing workload without additional resources

US FCMs’ residual interest buffers hit record low in December

March 20, 2024 (NO COMMENTS)A decade on from CFTC rules on residual interest target, firms’ segregated cash has not kept pace with client funds

Too soon to say good riddance to banks’ public enemy number one

March 19, 2024 (NO COMMENTS)As LockBit plans its comeback, experts say banks need a clear ransomware negotiating playbook

The race to build hyper-personalised investing

March 19, 2024 (NO COMMENTS)Direct indexing is taking off, but how far can it scale?

Energy credit optimisers vie to become the headline act

March 14, 2024 (NO COMMENTS)Competing initiatives may dilute ‘network effect’ as race to fill void left by TP Icap intensifies

EU watchdogs to launch prop trader capital review in April

March 13, 2024 (NO COMMENTS)Prop traders say bank-style IFR rules are driving them out, but doubt EBA will suggest changes

Canada’s top dealers boost derivatives clearing as FRTB kicks in

March 13, 2024 (NO COMMENTS)BMO, RBC and TD Bank cleared record C$45.1 trillion in notionals in Q1

Traders eye negative CDS-bond basis

March 13, 2024 (NO COMMENTS)Changed market dynamic can be profitable for those firms able to capture it

NAIC softens its rating overhaul. Insurers still don’t like it

March 12, 2024 (NO COMMENTS)Insurers worry that the regulatory body could override credit ratings without sufficient explanation

JP Morgan leads US banks’ FX trading revenues

March 12, 2024 (NO COMMENTS)Only two dealers saw revenue growth through 2023 as Goldman Sachs reports 75% drop

Singapore Exchange to return to short-term rates market

March 12, 2024 (NO COMMENTS)SGX president Syn hails new Sora and Tona futures as the “missing chunk of the rates complex”

Infrequent MtM reduces neither value-at-risk nor backtesting exceptions

March 11, 2024 (NO COMMENTS)Frequency of repricing impacts volatility and correlation measures

The quants who kicked the hornets’ nest – to champion causality

March 11, 2024 (NO COMMENTS)A small but influential cadre says the multi-trillion-dollar factor investing industry is based on flawed science

US FCMs far apart on target residual interest levels

March 11, 2024 (NO COMMENTS)Dealers diverge widely in how much capital they deem necessary to cover customer fund shortfalls

CFTC hears ‘call to action’ from swaps end-users on Basel III

March 8, 2024 (NO COMMENTS)Commissioner Pham mulls engaging with prudential regulators over capital hit on clearing

Snail race: the slow growth of securities lending CCPs

March 8, 2024 (NO COMMENTS)There’s underlying appetite to clear, but a structure to suit all participants is proving elusive

Euro area funds’ debt securities surged 13% in 2023

March 8, 2024 (NO COMMENTS)Investments vis-a-vis euro area issuers rebound after 2022 slump, driven by bond funds

Zero-day hedging takes root in new asset classes

March 7, 2024 (NO COMMENTS)Option users move beyond equity indexes in search of cheaper, sharper hedging tools

Canadian banks’ market RWAs spike on FRTB switch

March 7, 2024 (NO COMMENTS)CIBC, TD Bank and Scotia saw end-January charges jump amid overall ditching of internal models at Canada’s big five

Deposit insurance could transform outlook for China TLAC

March 7, 2024 (NO COMMENTS)Issuance needs drop dramatically if regulators allow maximum inclusion of deposit insurance fund

Euribor to ditch ‘expert judgement’ in May

March 6, 2024 (NO COMMENTS)Plan to infer euro funding costs from term version of €STR wins industry backing

Credit Suisse USA rounds 2023 with fifth VAR breach

March 6, 2024 (NO COMMENTS)Wall Street unit’s capital multiplier ratchets back up to 3.4x

Clobbered: how ‘toxic’ flows reshaped US Treasury trading

March 6, 2024 (NO COMMENTS)Volumes have dropped by more than a third at BrokerTec. The reasons are complex, the outlook uncertain

Canada’s FRTB pioneers get snowed on fund-linked trades

March 5, 2024 (NO COMMENTS)As Basel capital reforms go live, risk managers eye early adopters’ progress and push to improve capital treatment of fund-linked products

Five US banks hit record leverage exposures

March 5, 2024 (NO COMMENTS)Ballooning balance sheets leave Goldman, Morgan Stanley with razor-thin SLR buffers

How China’s equities intervention caused a quant fund quake

March 5, 2024 (NO COMMENTS)Popular leveraged market-neutral trade crumbled after government stepped in to support major indexes in February

Higher revenue pushes HSBC’s op risk up 14%

March 4, 2024 (NO COMMENTS)Increased net interest income over 2023 major driver behind six-year high figure

Emir 3.0 threatens lag for Simm revisions

March 4, 2024 (NO COMMENTS)New EU rules could stall changes aimed at improving risk sensitivity of industry margin models

ECB raised Pillar 2 charges for just three CRE-heavy banks in latest SREP

March 1, 2024 (NO COMMENTS)Pfandbriefbank and Luminor saw largest increases across 106 banks subject to 2023 assessment

Choppy inflation may be the worst inflation

March 1, 2024 (NO COMMENTS)Investors can build strategies to suit fast-rising prices, or slow-rising prices. What trips them up is the inflation foxtrot: slow, slow, quick, quick, slow

Esma pledges faster approvals for CCP margin model changes

March 1, 2024 (NO COMMENTS)Löber says regulatory sign-off on small model changes should take just three weeks under Emir 3.0

Large EU prop traders dump once-loved capital method

March 1, 2024 (NO COMMENTS)Industry lobbied for requirement based on margin haircuts, but it has provided little relief

Fed unveils hyper-Archegos test to reveal bank blow-up risks

February 23, 2024 (NO COMMENTS)CCAR for 2024 includes analysis of simultaneous defaults of five largest hedge fund clients

Goldman, JPM gain ground in FCM race for swaps

February 23, 2024 (NO COMMENTS)Duo boosted share of required customer funds at the expense of Citi and Morgan Stanley in 2023

Hedge funds find plenty to dislike in SEC’s dealer-rule rewrite

February 22, 2024 (NO COMMENTS)‘Nobody knows’ for certain which investing strategies might lead to firms being forced to register as dealers

Royal London to enter UK buyout market

February 22, 2024 (NO COMMENTS)Firm joins Utmost Group in planning to tap market this year

A change of TIIE: the knotty issue of Mexico’s benchmark switch

February 22, 2024 (NO COMMENTS)Outlier fallback methods and narrow window to build F-TIIE derivatives liquidity make for ambitious transition plan

Why cyber hack leaves EquiLend down but not out

February 20, 2024 (NO COMMENTS)Users turned to alternative securities lending platforms, but that may not mean lost market share

Hot topic: SEC climate disclosure rule divides industry

February 20, 2024 (NO COMMENTS)Proposal likely to flounder on First Amendment concerns, lawyers believe

Rabobank cuts back on ECL overlays

February 20, 2024 (NO COMMENTS)Improved backtesting performance reduces add-ons to allowances to lowest in five years

No Canadian banks using internal models as FRTB kicks in

February 19, 2024 (NO COMMENTS)One bank still plans to adopt IMA after delays prevented it going live in January

Dealers inch closer to clearing of FX forwards

February 13, 2024 (NO COMMENTS)LCH’s ForexClear aims to ease capital charges and margin constraints on banks, but will it kickstart clearing?

Shinhan, Kookmin set aside record reserves amid real estate worries

February 13, 2024 (NO COMMENTS)Kookmin provisions account for 38% of income; 23% for Shinhan

EU clearing houses want global standard on procyclicality

February 13, 2024 (NO COMMENTS)CCPs fear Europe will adopt its own prescriptive rules despite ongoing international consultation

ING’s op risk jumps 10% on model updates

February 12, 2024 (NO COMMENTS)Other European AMA users report moderate hikes

Digging deeper into deep hedging

February 12, 2024 (NO COMMENTS)Dynamic techniques and gen-AI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

BoE puts American spin on fix for FRTB’s govvies dilemma

February 12, 2024 (NO COMMENTS)Four jurisdictions find four different ways to resolve Basel market risk capital quirk

UBS predicts RWA cuts hampered by Basel III, model updates

February 9, 2024 (NO COMMENTS)Planned wind-down of unwanted Credit Suisse assets to be offset by $25 billion in add-ons

US climate guidance stokes debate over defining material risks

February 8, 2024 (NO COMMENTS)Banks welcome flexibility, but it could lead to big divergence on climate risk management

Dealers braced for Taiwan swaps clearing mandate

February 8, 2024 (NO COMMENTS)Expected FSC directive on TWD interest rate swaps could spur growth in FX clearing, say bank execs

Citrix Bleed hacks flag IT asset inventory shortfalls

February 7, 2024 (NO COMMENTS)To know what needs urgent patching, global banks first need to know what software they have

Europe’s new AI Act threatens supervisory ‘chaos’ for banks

February 7, 2024 (NO COMMENTS)Policy-maker says new role for European Commission could collide with ECB model risk regulation

Latest FDIC special assessment tougher than 2009 version

February 6, 2024 (NO COMMENTS)Most US banks face higher toll under new methodology

Bond funds made losing derivatives bets as rates climbed

February 6, 2024 (NO COMMENTS)Some managers’ use of interest rate derivatives looks like ill-timed speculation, study finds

Geopolitics is harsh terrain for FMIs

February 5, 2024 (NO COMMENTS)Idiosyncratic nature of disputes and flare-ups leaves exchange and infrastructure operators blending metrics with guesswork

CFTC trade reporting update turns into another rewrite

February 5, 2024 (NO COMMENTS)Expansion of Unique Product Identifier accompanied by 30 new, US-specific data fields

Shock EU expansion of clearing mandate may hook more funds

February 5, 2024 (NO COMMENTS)Last-minute change to Emir 3.0 would include cleared contracts in threshold calculation

Can risk parity ride out the storm of correlated asset chaos?

February 5, 2024 (NO COMMENTS)High interest rates, spiking inflation and correlation breakdowns are testing risk parity strategies

FMIs get busy, as supervisors circle

February 4, 2024 (NO COMMENTS)Via new roles and controls, exchanges and clearers hope to “get ahead” of regulatory wave

On cyber, FMIs seek to avoid being weapons of mass disruption

February 3, 2024 (NO COMMENTS)Controls focus on basic cyber hygiene, but communicating the risk remains a challenge

Mizuho’s life insurance swaptions notional climbs 575% in a year

January 24, 2024 (NO COMMENTS)Counterparty Radar: Prudential, Global Atlantic add substantially to positions in Q3 as market’s notional total grows to $184bn

US Bancorp adds on $8bn in long-term debt

January 24, 2024 (NO COMMENTS)Interest expense from LTD rises to $569 million in Q4

Basel III endgame expected to push PNC’s RWAs up 3%

January 23, 2024 (NO COMMENTS)Forecast from US regional much tamer than increases expected by advanced-approach banks

China snowball knock-ins fuel futures sell-off

January 23, 2024 (NO COMMENTS)Market participants say issuer re-hedging has helped drive Chinese equity indexes lower

Citi and JP Morgan vie to extend collateral optimisation to CCPs

January 23, 2024 (NO COMMENTS)High rates and increasing collateral requirements have ignited race for greater efficiency

Clearing members cheer plan for more transparency on CCP margin

January 23, 2024 (NO COMMENTS)European Parliament wants to amend Emir 3.0 draft to put extra obligations on clearing houses

Council of the EU resists centralised clearing house supervision

January 23, 2024 (NO COMMENTS)Esma wants more powers, but member states will only agree to provide it with more information

IM surges at LCH following CDS users’ shift from ICEU

January 22, 2024 (NO COMMENTS)Figures for Q3 show 16% jump at Paris-based CDSClear

LDI firms update margin stress tests post-gilt crisis

January 22, 2024 (NO COMMENTS)For some managers, stress-testing models failed to reflect the convexity effects of the crisis on initial margin

Soured CRE loans pile up at BofA, Wells Fargo and PNC

January 19, 2024 (NO COMMENTS)Proportion of non-performing loans surges past the pandemic’s worst stretches

Cleared US repos hit record high as MMFs wean off Fed

January 18, 2024 (NO COMMENTS)Deflating tri-party volumes coincide with FICC DVP trades’ climb to $2tn

Op risk data: US piqued by Pictet tax breach

January 18, 2024 (NO COMMENTS)Also: US Bank’s Covid failings; South Korea’s short-selling clampdown. Data by ORX News

Regulators’ FRTB estimates based on faulty premise – industry study

January 17, 2024 (NO COMMENTS)US market risk capital requirements could more than double if banks abandon IMA

Corporates eye FX options as hedging costs shrink

January 16, 2024 (NO COMMENTS)With hedge ratios tipped to rise, dealers say treasurers are increasingly open to optionality

Creditors struggle to stop stressed firms borrowing more

January 16, 2024 (NO COMMENTS)Dropdowns, uptiers and double dips grow in number, and lenders can't prevent them

Holes in the netting: the limits of CME-Ficc cross-margin deal

January 15, 2024 (NO COMMENTS)Big margin savings for some, but more needed to ease pressure of UST clearing mandate

Clearing members sour further on cash for IM collateral

January 15, 2024 (NO COMMENTS)Sovereign bonds remain preferred choice at top CCPs in Q3

Polish benchmark transition hits new snag

January 15, 2024 (NO COMMENTS)Compounded index suspended over data errors as Wibor extension reopens successor debate

SA-CCR charges double at OCBC in Q3

January 12, 2024 (NO COMMENTS)Singaporean bank’s counterparty credit risk up 28% to multi-year high

BMO Capital Markets gaining ground in US Treasuries

January 12, 2024 (NO COMMENTS)Canadian bank goes head-to-head with large US bulge brackets in D2C market

Growing regulatory focus fuels climate risk staffing fight

January 12, 2024 (NO COMMENTS)Widespread poaching as banks find repurposing existing quants may not provide the right expertise

LCH-JSCC basis turns negative on BoJ policy shift

January 11, 2024 (NO COMMENTS)Changes in hedge fund positioning at LCH seen as driver of inversion on 20-year swaps

Citi swaption volumes surge as BlackRock relationship flourishes

January 11, 2024 (NO COMMENTS)Counterparty Radar: Market leader Pimco cuts nearly one-third of book in Q3

US MMF repos with dealers hit record amid RRP pullback

January 11, 2024 (NO COMMENTS)Non-Fed trades up 13% in November as facility’s usage declines rapidly

Concentration risk ticks up at large CCPs

January 10, 2024 (NO COMMENTS)Top five clearing members accounted for almost half IM and open positions in Q3

The cost of mis-specifying price impact

January 10, 2024 (NO COMMENTS)Expected returns can be significantly affected by the wrong use of impact models

Former NY Fed chief calls for overhaul of discount window

January 9, 2024 (NO COMMENTS)Dudley’s proposed changes include prepositioning collateral, cutting costs of secondary credit facility

US climate guidance stokes debate over defining material risks

January 8, 2024 (NO COMMENTS)Banks welcome flexibility, but it could lead to big divergence on climate risk management

Climate refugees, zero-day options and the wrong long

January 5, 2024 (NO COMMENTS)A look at the investment risks that just missed our annual list

Geopolitics is harsh terrain for FMIs

January 5, 2024 (NO COMMENTS)Idiosyncratic nature of disputes and flare-ups leaves exchange and infrastructure operators blending metrics with guesswork

AmEx expansion puts it on track for tougher prudential standards

January 5, 2024 (NO COMMENTS)Lender is within spitting distance of category III designation, which would attract stricter capital and liquidity requirements

Pimco’s interest rate swaps book shrinks 21% in Q3

January 4, 2024 (NO COMMENTS)Counterparty Radar: BlackRock and Capital Group also trim positions to drive down swaps usage by US mutual funds

Citi, JP Morgan bail-in buffers ebb above minimums

January 4, 2024 (NO COMMENTS)Duo’s long-term debt headroom closest to regulatory requirements among top US banks

FMIs get busy, as supervisors circle

January 4, 2024 (NO COMMENTS)Via new roles and controls, exchanges and clearers hope to “get ahead” of regulatory wave

A new method for the pricing of share buy-back programmes

January 3, 2024 (NO COMMENTS)The features of buy-back programmes

The top 10 investment risks for 2024

January 3, 2024 (NO COMMENTS)New fears include mounting government debt, the rise of AI, a credit crunch and regulatory overkill

On cyber, FMIs seek to avoid being weapons of mass disruption

January 3, 2024 (NO COMMENTS)Controls focus on basic cyber hygiene, but communicating the risk remains a challenge

LMAX taps real money clients with Cürex deal

January 2, 2024 (NO COMMENTS)Acquisition aims to offer liquidity providers diverse flows from asset managers

Information security: too important to leave to the experts?

December 22, 2023 (NO COMMENTS)Holding a trove of sensitive data, FMIs seek greater safety through shared oversight and smarter reporting

Goldman, Barclays, MUFG reap largest G-Sib score cuts

December 22, 2023 (NO COMMENTS)Compressions driven by reductions in complexity and cross-border activity

Climate capital outlook unclear as EBA rejects green risk weights

December 21, 2023 (NO COMMENTS)European regulator suggests climate change must be factored into existing risk categories

Op risk data: Monster real estate loan fraud bites Vietnam’s SCB

December 20, 2023 (NO COMMENTS)Also: Binance brought to book, Rabobank reprimanded over bond cartel. Data by ORX News

The unknown risk on the flip side of the basis trade

December 19, 2023 (NO COMMENTS)US mutual funds have amassed record notionals in Treasury futures that in some cases exceed their AUM

Regulators pushing CCPs and exchanges on op risk

December 18, 2023 (NO COMMENTS)Op Risk Benchmarking: In latest batch of data, FMIs report growing scrutiny, plus watchdog asks for stress tests, monitoring and more

Repo price spike concentrated in FICC DVP market

December 14, 2023 (NO COMMENTS)Soaring demand for cleared repo blamed for largest SOFR spike in four years

AllianceBernstein: fine-tuning shrinks gen AI ‘hallucinations’

December 13, 2023 (NO COMMENTS)Asset manager says its tweaks have improved accuracy of LLM models

Loss of ruble volatility waiver costs UniCredit €2.2bn in RWAs

December 8, 2023 (NO COMMENTS)Lender forced to capitalise FX risk from Russian operations after ECB withdraws key exemption

Industry confused by EU’s ‘bingo card’ clearing rules

December 8, 2023 (NO COMMENTS)Uncertainty over definition of representative trades in Emir active account requirement Market participants warn the complex requirements..

Repo clearing could spur CDM adoption – Barclays

December 8, 2023 (NO COMMENTS)UK bank’s tech group believes repo market is primed for new data standards Mandatory clearing of US Treasury repo could be a catalyst for the adoption..

Blow-out on ‘dim sum’ bonds fuels boom in offshore rates options

December 8, 2023 (NO COMMENTS)Swaptions on USD/CNH swaps enjoy boost as investors adopt ‘all-you-can-eat’ approach to callables

HSBC leads global uptick in OTC derivatives clearing

December 8, 2023 (NO COMMENTS)Systemic banks cleared record €250 trillion in notionals in 2022 HSBC grew its cleared swaps book by 11 percentage points in 2022..

Clearing members combing rule books after LME lawsuit win

December 4, 2023 (NO COMMENTS)Industry debates whether other CCPs and exchanges would cancel trades if faced with similar crisis

China G-Sib scores tell story of lenders’ decade-long rise

December 4, 2023 (NO COMMENTS)Chinese banks capture far larger share of systemic risk than in 2013

SEC criticised for belt-and-braces ban on volume-based pricing

December 1, 2023 (NO COMMENTS)Legal experts question need for rules to prevent firms disguising agency trades as proprietary

PFZW’s payout to pensioners jolts euro swap curve

December 1, 2023 (NO COMMENTS)Dutch retirement fund’s announcement of unexpectedly large indexation takes market by surprise

Investment house of the year: Schroders